Sample Questions: Principles of Macroeconomics

The following Principles of Macroeconomics sample questions aren't used in actual CLEP exams and aren’t presented here exactly as they will be on the test. Use them to get a sense of question format and difficulty level.

Directions

An online scientific calculator will be available for the questions on this test. For each question, select the best of the choices given. Some items reference a table or graph—insert those figures where noted.

Questions

The table below shows the production possibilities for Country X and Country Y. Assume both countries can either produce cotton or wheat using the same quantity of resources. Would trade be beneficial to both countries, and if so, which good would each country produce domestically and which good would each country import?

Production Possibilities Country X Country Y Cotton 800 1600 Wheat 1600 800 - Yes; Country X will produce cotton and import wheat.

- Yes; Country Y will produce wheat and import cotton.

- Yes; Country Y will produce cotton and import wheat.

- Yes; Country X will produce some cotton and import some wheat.

- No, trade will not be beneficial for the two countries.

Assume both consumers and producers of soybeans expect prices for soybeans to increase in the near future. What will happen to the equilibrium price and quantity of soybeans in the market in the short run?

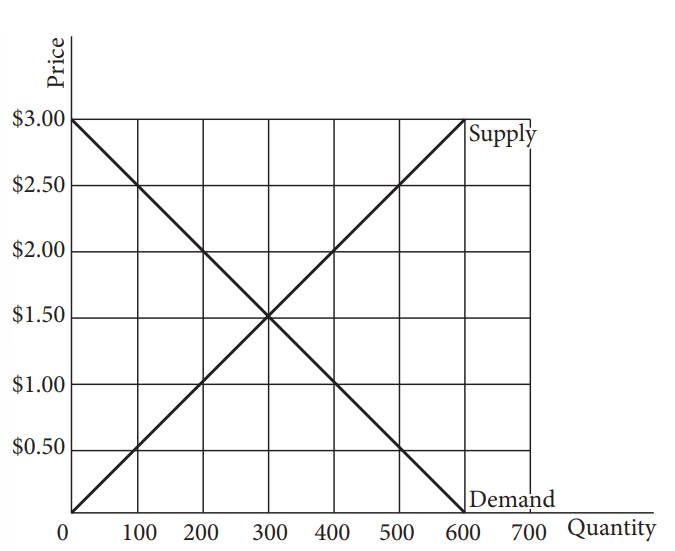

Equilibrium Price and Quantity Outcomes Choice Price Quantity A. Increase Decrease B. Increase Indeterminate C. Decrease Indeterminate D. Indeterminate Increase E. Indeterminate Decrease - A surplus of 200 units would exist in the market described by the graph below at a …

- Market graph referenced in Question 3.

- price floor of $2.50

- price floor of $2.00

- price floor of $1.00

- price ceiling of $1.00

- price ceiling of $2.00

- Which of the following will cause the short-run aggregate supply curve to shift to the right?

- An increase in the price level

- An increase in the government budget deficit

- A decrease in the price level

- A decrease in real wages

- A decrease in productivity

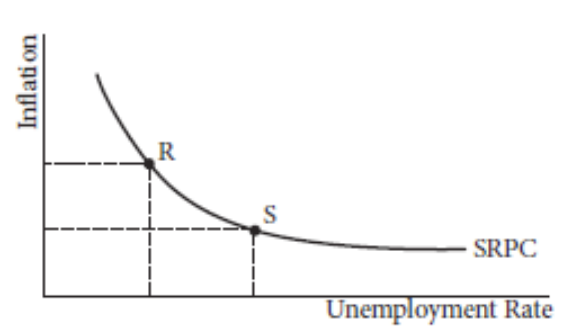

- Which of the following best explains the movement from point R to point S on the short-run Phillips curve (SRPC) shown?

- SRPC referenced in Question 5.

- An open-market sale of government bonds by the Federal Reserve

- An increase in government spending

- A decrease in income tax rates

- An increase in aggregate supply

- An increase in aggregate demand

If 2010 is the base year for the “basket” of goods in the table below, the price index for 2015 is equal to:

Basket of Goods, 2010 and 2015 Prices Item Quantity 2010 Prices 2015 Prices X 10 $4.00 $5.00 Y 10 $4.00 $5.00 Z 10 $4.00 $5.00 - 75

- 100

- 125

- 150

- 175

- Assume that the short-run aggregate supply curve is horizontal and the marginal propensity to consume is 0.75. Assuming no crowding out and no international trade, if the government wants to increase equilibrium GDP by $100 million, it should increase government spending by:

- $20 million

- $25 million

- $40 million

- $75 million

- $100 million

- Which of the following will cause the real interest rate to decrease in the loanable-funds market?

- A decrease in taxes on investment

- A decrease in the money supply

- An increase in private savings

- An increase in aggregate demand

- An increase in government borrowing

- The Federal Reserve can undertake which of the following policy actions to address the problem of inflation?

- Decreasing the income tax rate

- Decreasing the federal funds rate

- Decreasing the money supply

- Decreasing the required reserve ratio

- Buying government bonds on the open market

- Which of the following government policies is most likely to lead to long-run economic growth?

- Increasing taxes on corporate income

- Increasing taxes on income received from foreign investment

- Decreasing the money supply to raise the real interest rate

- Establishing a price control to curb inflation

- Increasing spending on human capital

- If the United States dollar depreciates in the foreign-exchange market, which of the following will occur?

- The price level in the United States will decrease.

- United States exports will increase.

- Goods produced in the United States will become more expensive to foreign consumers of these goods.

- The United States current-account deficit will increase.

- The United States demand for imports will increase.

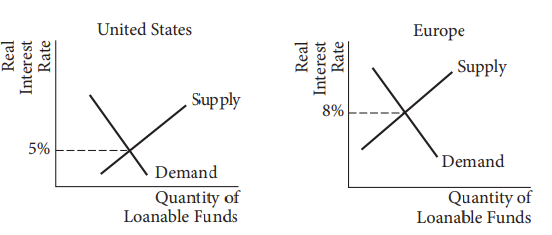

- The loanable-funds markets in the United States and Europe are in equilibrium, as shown in the graphs below. Which of the following is most likely to happen?

- Loanable funds market graphs referenced in Question 12.

- Outflow of financial capital from Europe to the U.S., lowering interest rates in the U.S.

- Outflow of financial capital from Europe to the U.S., raising interest rates in the U.S.

- Inflow of financial capital to Europe from the U.S., raising interest rates in Europe.

- Inflow of financial capital to Europe from the U.S., lowering interest rates in Europe.

- No change in financial-capital flows, keeping interest rates unchanged.

Answers

1) C 2) B 3) B 4) D 5) A 6) C 7) B 8) C 9) C 10) E 11) B 12) D